CGG Commences Second Phase of Largest OBN Multi-Client Survey in UK CNS

Paris, France | Sep 24, 2020

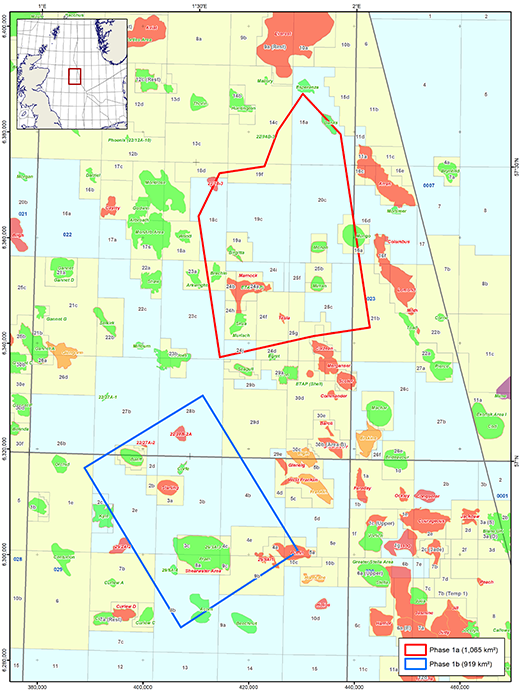

CGG announced today completion of the first phase of its multi-year program to deliver the largest OBN multi-client survey ever acquired in the UK Central North Sea (CNS) and immediate commencement of the second acquisition phase. The survey started in March 2020 and has already received significant industry interest and prefunding, with first images targeted for Q1 2021.

The Central North Sea is a highly prospective region of the UK Continental Shelf. With recent discoveries, including Glengorm and Isabella, there is increasing focus on the deeper, higher risk Jurassic and Triassic plays, typically under high pressure, high temperature conditions. Furthermore, the presence of complex structural processes associated with Permian salt movement has created significant challenges to imaging these deeper reservoir targets.

As a leading provider of tailored, high-end, high value multi-client datasets, CGG is uniquely qualified to undertake this landmark OBN program. This new survey, with its long-offset, full-azimuth coverage and good low-frequency signal in a shallow water environment, together with CGG’s best-in-class OBN processing and advanced imaging technologies, will provide a step-change in seismic image and reservoir characterization quality, bringing new insight to help de-risk these plays and aid continued development of existing fields in the CNS region.

Sophie Zurquiyah, CEO, CGG, said: “We are pleased to announce the commencement of the second phase of this exciting OBN program which will complement CGG’s extensive high-quality Cornerstone towed-streamer data library and further deliver unprecedented industry insight in this critical Central North Sea area. The new data set will provide our clients with the best available information to de-risk the awarded blocks from the UK 32nd License Round and support the UK Oil & Gas Authority’s strategy for Maximizing Economic Recovery.”

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).